US Military: Banking in Korea

Here are some things that individuals associated with the US Military may want to know about opening a checking account in South Korea.

About Banking In Korea

Like banking systems around the world, Korean banking is designed for the people of South Korea and the Korean social systems. Much like the United States does not allow foreign nationals to freely open bank accounts free of all restrictions, South Korea also has banking requirements for international residents.

This blog post will talk about some (but not all) of the ways South Korean banks may be different from US banks. Like all countries, South Korea has its own banking culture. Understanding some of the ways banking in South Korea differs from your home country may help the transition go more smoothly.

Types of Korean Banking Organizations

Like in other countries, there are different types of banking institutions in South Korea. There are virtual banks like Kakao Bank, International banks, Credit Unions, National Banks, etc. Each of these banking institutions, much like the United States, has different rules which govern what they can and can’t do and who they can and can’t serve.

A List of South Korean Credit Unions

- Saemaeul Finance Association (새마을금고)

- Agricultural cooperatives (농업협동조합, 농협) (ie, Nonghyup)

- Fisheries cooperatives (수산업협동조합, 수협)

- Forestry cooperatives (임업협동조합, 임협)

Korean Credit Unions May Be Unwilling to Open US Military Accounts

Many foreigners do not have successful banking experiences with Korean credit union-style banks such as Nonghyup. The US Military-affiliated people may not be able to open accounts at all due to an A3 visa type. This situation exists because Credit Unions may not offer easy international money management, and their services are tailored for their focus groups.

I showed my A3 visa at Nonghyup and they just said, “No.” I had to go try another bank. They did not even entertain the thought of opening an account.

Military spouse

This can be confusing since many Nonghyup Bank locations – 농협중앙회 (A type of agricultural cooperative) have branches outside of US military bases. Such credit unions exist for local industry rather than for the base itself. US Military may need to find a national bank location instead for opening bank accounts.

A List of Banks In South Korea

- Bank of Korea: www.bok.or.kr

- Barclays: www.barclays.com

- BNP Paribas: www.bnpparisbas.com

- Citibank: www.citibank.co.kr

- HSBC: www.hsbc.co.kr

- ING: www.ing.com

- Kookmin Bank: www.kbstar.com

- Korea Development Bank: www.kdb.co.kr

- Korea Exchange Bank (KEB Hana): https://www.kebhana.com/

- Shinhan Bank: www.shinhan.com

- Standard Chartered (First) Bank www.scfirstbank.com

- Woori Bank: www.wooribank.com

Recommended Banks for the US Military

The following Recommended Banks list for the US Military does not mean that other national Korean banks will not work with individuals associated with the US military. Such a list simply denotes the banks South of Seoul that volunteers have documented the most successful US military personnel and DODEA-affiliated personnel experiences at certain bank branches.

This Recommended Banks for the US Military list may be subject to change based on Korean law and branch rules. The following banks have a history of offering checking accounts to US Military.

- Korea Exchange Bank (KEB Hana): https://www.kebhana.com/ (Domestic English Support 1599-6111)

- Kookmin Bank: www.kbstar.com (Domestic English Support 1599-4477)

Update: Shinhan Bank in Pyeongtaek told our volunteers they stopped providing bank accounts to US Military-affiliated people in 2025. This may change over time.

South of Seoul volunteers recommend calling to talk to banks to learn about the checking accounts in English prior to visiting a local bank branch to open your account. Calling before visiting a local bank may help you feel prepared with the correct paperwork and knowledge of what type of account you need to open. Such knowledge may make it easier to work with the teller who may have little to no English ability.

A Common Checking Account Type Offered to US Military

Unemployed spouses of the US military or DODEA will likely be offered a Limited Checking Account. Such limited accounts are a common global practice, unemployed international residents. The Limited Checking Account rules may look something like this:

- Unlimited money may be deposited into the account

- Debit card transactions are allowed for the total amount in the account

- Daily cash withdrawal limit of 300,000 won from ATMs

- Daily cash withdrawal limit of 300,000 won from a teller.

- Limits related to bank transfers

- Limits related to online banking transfers

What this means in practical application is that you can freely use your debit card based on the amount of money in your account, but will be limited from taking large amounts out of ATMs or moving large amounts between accounts. Generally speaking, the limitations associated with the Limited Checking Account may not have a large impact on life.

Additional Checking Account Types

Additional checking account types with different limits for different types of transactions may be allowed based on verifiable income and visa type.

Recommended for Korean Bank Branches for US Military Living in Pyeongtaek

KEB Hana Bank

031-655-1111

Copy and paste phone numbers into Naver Maps to get directions

Hangul Name:

하나은행 평택금융센터

Hangul Address:

경기 평택시 평택1로 5

Description:

A bank that works will with foreigners opening accounts in Korea. They will work with US military who do not have a Korean ID. This bank opens on Sundays. Arrive early to get a spot in line. It can often be very busy on Sundays.

Items US Military Affiliated People May Need To Open A Korean Bank Account

All paperwork for opening a bank account in South Korea may change over time. Generally speaking, US military or DODEA spouses should provide the following information may be required:

- Passport

- FRC (Also known as an ARC (Learn How US Military can apply for an FRC)

- Military ID

- Korean phone number registered in your name and your FRC

- US social security card (maybe you need it, maybe you don’t. depends on the teller)

- W-2 form (If employed. If not employed, nothing is needed.)

Active military or DODEA employees may be asked for:

- Passport

- FRC (Also known as an ARC (Learn How US Military can apply for an FRC)

- Military ID

- Korean phone number registered in your name and your FRC

- US social security number (copy of card not always required, but handy to have)

- Orders or proof of employment

Useful Phrases for Visiting the Bank:

Explicitly Request Each Banking Feature

When you do your banking, you will need to be explicit about your banking needs. You must not assume the teller understands when you need them to do. You need to clearly ask for each banking feature that you need. The concept of “upselling” the customer is not a Korean banking standard. If you ask them to “open a checking account,” this may be all they do.

Example Script for Opening Your Bank Account in Korea

Spouse of US Military or DODEA Employ: Hello. I am with the US military. I do not work in Korea. Here is my passport and Korean ID. (Put these items on the table in front of you). I would like to open a limited checking account. I want a debit card. I want online banking and I want phone banking.

For best results, stay aware that your teller does not speak English as a first language (or at all). Confirm at least 3 times that they have activated BOTH internet and phone banking for your account. It’s very easy for one to be missed in the stress of a bilingual interaction.

Request a Check Card (Debit Card)

Request a debit card. You need to be clear that you want a debit card (체크카드) and not a credit card. Each bank will offer either Visa or MasterCard, but not both. You will not be able to choose. They will make this at the bank, and you may be able to use it immediately.

Online Banking and Phone Banking Are Separate Features

Request online and phone banking. You must sign up for both of these services individually. You will need a Korean phone number attached to your FRC in order to use phone banking. You may be required to download special software to use online banking. It’s a whole new process where you will need to learn new security systems.

You Must Register for Online Banking and Phone Banking in person at a Bank Branch. You can not set up online banking or phone banking at home on your own. You can not set up internet banking or phone banking over the phone. You MUST ask for these services in person. It can be done when you open your account.

Estimated Time to Open a Korean Bank Account

Realistically speaking, it will take 1-2 hours to completely set up your bank account. For best results, visit the bank in the morning. We do not recommend attempting to set up a bank account after 3pm or around 12pm due to lunch hour and evening rush.

Different National Bank Branches May Have Different Rules

In Korean business, much like the Korean government, individual branches of an organization may have great freedom in creating their own systems. What this means for international residents is that different bank branches may ask for different paperwork or offer different types of accounts. Even if you verify what you need on the phone with the bank headquarters, some details may be different in person.

Since the US military-associated person may not be employed by a South Korean company, it may create challenges related to opening bank accounts at some bank locations. Additionally, if the person opening the bank account is an unemployed spouse on an A3 visa, many bank branches may not be willing to open accounts. It is important to know which bank branches have the authority and systems in place to work with your visa type.

Banking Culture in South Korea

When documenting the culture shock US military personnel experience related to Korean banking systems, South of Seoul has found the following items important for the US military-associated people to know. Some of the following items may create positive culture shock, while others may create stress points.

Some Check Cards Can Double as Transportation Cards (T-Money Cards)

Some banks allow check cards to be used as transportation cards. You simply deposit 30,000 won, which will be held for transportation. You can set this up as an autoload feature when refills when you have used up your transportation account balance. (KB Bank offers such a feature.)

No Joint Accounts in South Korea

In South Korea, adults do not share bank accounts. In order to have a check card in your name, you must have your own checking account. This means that both husband and wife need to open their own accounts in order to have equal access to the benefits offered by Korean banking.

Banking Fees in South Korea

South Korea does not have as many banking fees as banks in the United States. If you accidentally use your debit card and your limit is low, the charge will be declined, but you may not be charged a fee. Additionally, monthly checking account fees and ATM fees are far lower. In fact, Korean checking accounts have very few potential fees, which may make them relatively stress-free.

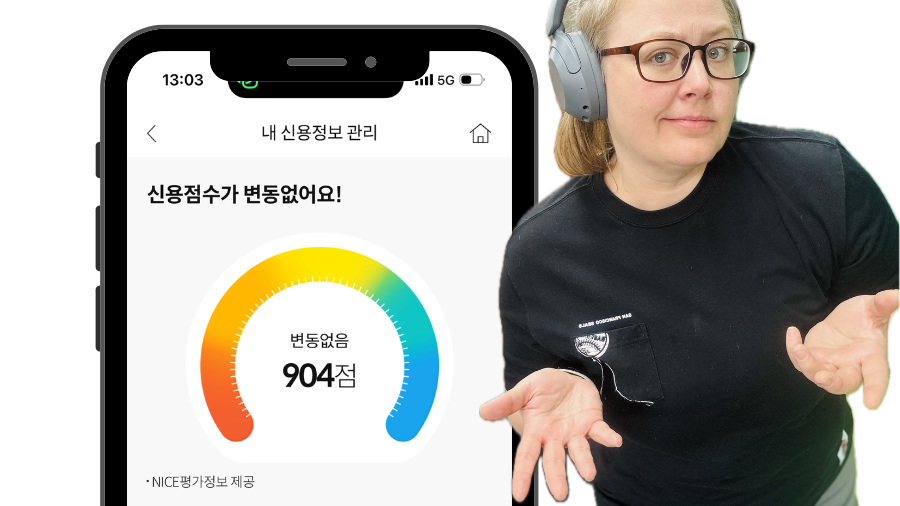

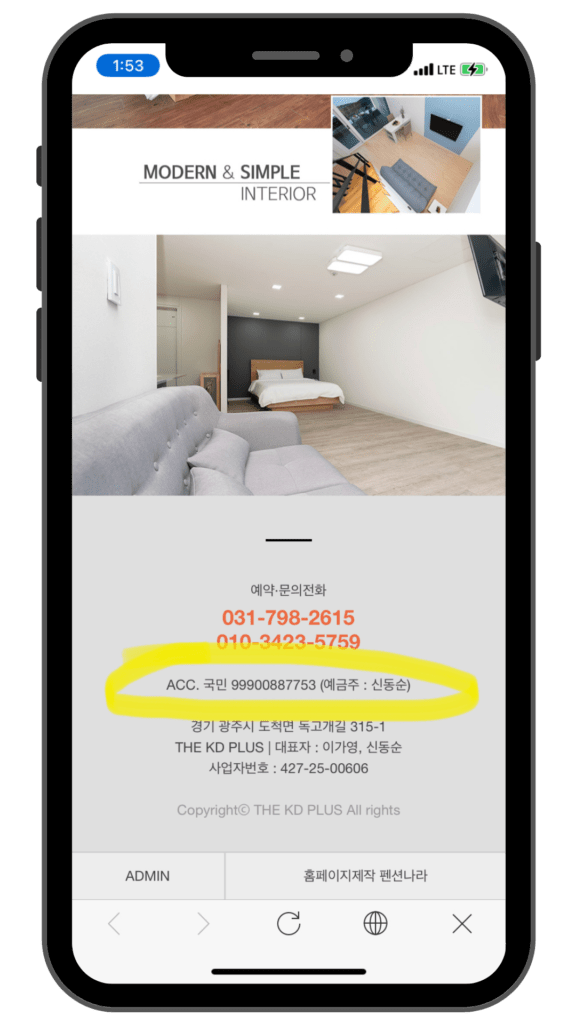

The Public Sharing Bank Account Numbers Is Common

In South Korea, we freely share and post our bank account numbers. Businesses (especially small businesses) often have their bank account numbers posted at the point of check-out, on business cards, and on their websites. You may even get a discount for using the bank transfer option.

Additionally, others will comfortably ask you for your bank account number. Businesses, strangers, and friends will not be shy about asking for your bank account number, and no one will understand why you would not want to provide your bank account number. A friend may ask for your bank account number in order to transfer money, or a business may ask for your bank account number for different types of transactions.

If you become angry or defensive about providing your bank account number, the person you are working with may be greatly offended and confused. What may seem very unsafe based on US banking practices feels comfortable and sustainable in South Korean banking culture.

Person to Person / Person to Business / Business to Person Transfers

Residents of South Korea love to pay for things using bank transfers. Such transfers can occur via:

- ATM

- Smartphone App

- Online banking

- Virtual banking

Businesses may even offer discounts for paying via bank transfer. As previously mentioned, this means bank account numbers are freely shared. Many businesses may only accept cash or bank transfers. Especially tour and travel companies.

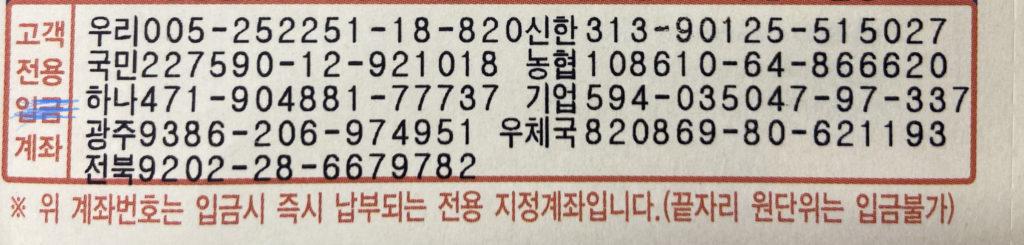

In order to make a bank transfer, you need to know:

- Recipient’s Bank Name

- Recipient’s Bank Account Number

- Account-holders name (for verification purposes)

Some businesses or utilities may even offer multiple deposit accounts for you to choose from so that you do not have to pay transfer fees. For example, if you have a Hana Bank Account (하나) you might choose to transfer to a Hana Account (See below photo)

Bank Transfers Are Nearly Instant

Once you transfer money, the money almost instantly arrives in the recipient’s account, available for use. It’s hard for any of us to understand how long banking takes in the US.

Korean Banking Hours

Banks are generally open from 9:00AM to 4:00PM, Monday through Friday. They will usually not take new customers after 3:30pm. There is generally no weekend banking in Korea. However, there are some exceptions to this rule. For example, Hana Bank has one location in Cheonan and one location in Pyeongtaek with limited Sunday hours. Other locations such as these may exist in other cities as well.

SPECIAL NOTICE: During the pandemic, some banks and branches close at 3:30pm and you must have a number by 3:00pm in order to be served. If the bank closes before your number is called, you will need to come back the next day. We recommend arriving by 2:00 in order to open a new account.

Somewhere Between 12:00am and 2:00am, Every Bank May Electronically ‘Close’ for 1-2 Hours

This means that between 12 – 2 am you may not be able to:

- withdraw money from an ATM

- use your credit card

- use your phone app

- do online banking

In short, you have ZERO access to your money for about 1-2 hours every night (It varies by bank) either physically or electronically. For this reason, many residents carry cash for a night out or will wait to go home until after 2am.

Certain Banking Locations May Cater More to International Customers

Since each bank branch has a certain amount of authority to serve the local population, bank branches in foreign-rich areas may offer more language and banking support services in English.

Korean National Banks Offer English Language Smartphone Apps

In the past few years, most national Korean banks have launched phone banking apps in English. Each of the banks recommended in the Recommended Banks for the US Military list by South of Seoul offers easy-to-use (once it has been set up) phone banking in English.

Keep in mind, nothing is easy to use when you get started. You will need to learn a new type of banking culture and user interface. You may struggle with how words are used, where actions can be taken, and the process for setting up security.

Not all phone banking systems in South Korea are available to international residents. Apply for loans, credit cards, and opening accounts must still be done in person. Credit cards are usually not available to anyone without a work contract. Additionally, credit cards can not be issued in the three months prior to visa renewal.

English Names of Banks Vary

Banks often have different versions of their name in English. This may cause confusion when searching for banking information. For example, 하나은행 might be called Hana, Hanga Bank, KEB Hana, KEB Hana Bank, etc. Navigating bank names in English is not always easy since banks also have different names for different banking products.

More Information for US Military Living in South Korea

Founded in 2015, the South of Seoul team consists of volunteers on three continents working together to support English-speaking people traveling or living in South Korea. South of Seoul volunteers work with organizations and individuals across South Korea to improve equitable access to information across South Korea. Much of South of Seoul’s information focuses on Pyeongtaek, Gyeonggi-do, South Korea.

Blogs published under the authorship of “South of Seoul” include blogs compiled by multiple volunteers to improve access to standardized information unrelated to individualized personal experiences.